HOW TO MAKE PROFIT INTRADAY TRADING IN INDIA :

Hello every one i am full time trader i am very happy to share you what are the techniques i am followed in market ,how professional traders making huge money in trading and today i am going to show you how to make good profitable trade ,plan your trade why because Before entering a trade you may control your emotions your are making money for living

not gambling so kindly avoid greed in trading,follow rules in trading make huge profit and cut losses

HOW MUCH DO DAY TRADERS MAKE :

don’t expect to make too much of money in a single trade,try to make consistent profit in daily basis's

professional traders did not expect quick money if they take any trade they know very well where to enter where to exit because they follow rules in trading

CLIK TO WATCH VIDEO HOW TO MAKE MONEY TRADING :

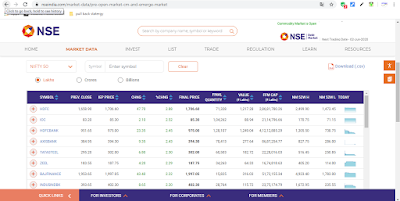

HOW TO MAKE MONEY IN TRADING STOCKS :

don't take more than two trades in a day because you pay more money for Taxes and losses for brokerage and important thing you have limited time to carry your positions in intrady trading so you have time limit in day trading,

HOW TO EARN MONEY IN SHARE MARKET DAILY :

professional traders follows money management principle it is more important for traders who want to money in trading learn how to make profit in stock market to know about how professional traders money making in trading make use of it free educational content