BEST STOCK SELELCTION METHOD FOR INTRADAY :

Hello traders welcome to this website today I am going to show how to select intraday stocks how to make profit in intraday using this stocks selection method today we are going to see stock selection method in this video you can click and watch this video for more idea

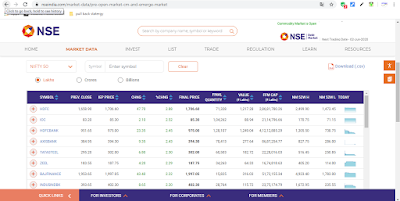

Just go to NSE India website : https://www.1.nseindia.com you can see market data just click market data and select pre open market number of stocks listed here how to select stocks just select top 5 stocks and scroll down you can select the under list you can add this stocks to the watch list it will works amazingly it gives good result in intraday trading.

CLICK HEAR TO WATCH VIDEO:

Second type : Second type go to Google website and click "oi spurts" on the Google search engine when you hit the search button you can see the first link

https://www1.nseindia.com/products/content/equities/equities/oi_spurts.htm

open interest stocks will be displayed in this website you can select the stocks which can move more than 6 % of open interest when price also increases and open interest also increases more than six percent its a good stock for trading .

This technique you can watch a stock price also increases and volume also increases open interest also increases for buying .

For selling price decrease volume increases open interest increases in this stock is ready for sell.

How to select stocks from top gainers

Go to NSE India website under select top 10 gainers and losers in top you can see F&o securities can select stock not move more than 1 %

Final step final strategy

open any stock in your trading platform you can watch price also increases step-by-step and volume also increases for buying

You have posted a video long back explaining supertrend with exponential moving average and also rsi indicator. Till yesterday,but I accidentally deleted my studies in zerodha. It had given me profits..please help me

ReplyDelete